"Tomorrow belongs to those who prepare for it today" Malcolm X

29/01/21

Simon Martin, Branch Manager and Senior Investment Manager, Charles Stanley Leeds

Like an awful lot of people, we often wish that we could go back in time and change things or do something differently to benefit from hindsight. As investors we also sometimes wish we could see into the future to gain an insight into what is going to happen around the proverbial corner. Until this week I thought that this was just fantasy, but it transpires that we can all see into the future!

We are seeing into the future every single moment of each day we live. The reason I can make this bold statement is that it takes about 200 milliseconds or a fifth of a second for information to travel along the optic nerves and into the brain for it to be processed and interpreted. A fifth of a second is not a trivial span of time when rapid response is required such as avoiding the proverbial double decker bus. To help us better deal with this fractional lag the brain does a truly extraordinary thing. It continually forecasts what the world will be like a fifth of a second from now, and that is what gives us the ability to react and protect ourselves. That means we never see the world as it is in this very instant, but rather as it will be a fraction of a moment in the future. We spend our whole lives, in other words, living in a world that does not quite exist yet.

I appreciate that I am being a bit facetious but a key lesson from 2020 was how difficult it is to forecast the future. It also does not mean that we should not try and trying to see into the future and imagining what might happen, is key to managing investments. We have to look forward and base decisions on estimated and projected figures. The trick is to know which data is more reliable and less likely to change. We know that some analysts extrapolate what has happened in the past and then use that data as a guide to what may happen in the future and a chartist looks at movements in share prices to try and work out what might happen in the future. These methodologies can work but after the sharp movements over the past 12 months we can also see how quickly this data can change and in effect become worthless as a means of predicting the future. However, as we have pointed out on many occasions there is a lot of data that is far more reliable and helps us to build a much clearer picture of what may transpire. This helps us to plan and build our guide to how we should be investing money for clients. The examples below have been key to the development of our investment themes.

- Demographic growth rates in Asia and the developing world

- Global population growth and how populations are aging

- Looking at population profiles

- Spend on improving the environment

- Urban growth trends

- Health care spend

- Technology innovation

As you will probably gather from the next few paragraphs I have been reading again! This time it has been Bill Bryson's excellent book on the Body. Having just finished, I can thoroughly recommend this book. It is suitable for both the ‘glass half full' and 'glass half empty' readers.

I thought I would highlight a small number of the amazing facts from the book to help demonstrate some of the growth figures in healthcare innovation and why we can use this type of information to look into the future.

Improving Heart treatment has been one of the huge success stories of modern medicine. Death rate from heart disease has fallen from almost 600 per 100,000 people in 1950 to just 168 per 100,000 today. But it is still one of the leading causes of death. In the United States alone, more than 80 million people suffer from cardiovascular disease and the cost of treating heart related illness in US is around $300billion a year.

New cases of diabetes, from all parts of the world are soaring and between 1980 and 2014 the number of adults in the world with diabetes of one type or the other went from just over 100 million to well over 400 million; 90% of them have type 1 diabetes. Unfortunately, type 2 is also growing especially quickly in developing countries that have been adopting bad western habits of poor diets and inactive lifestyle. Therefore, we can conclude that sadly, obesity is a big issue in both the developed and developing world, and nowhere more so than in America. According to the World Health Organisation (WHO) more than 80% of American men and 77% of American women are overweight and 35% of them are obese, up from just 23% as recently as 1988.

In roughly the same period obesity more than doubled in the US children and quadrupled in adolescent. In America the annual cost of treating diabetes is $327billion a year.

Perhaps, the most damming statistic which emphasises the increase in weight gain is that, today, the average US woman weighs as much as the average man weighed in the 1960’s. In that half century the average woman’s weight has gone from 63.5 Kilos (10 Stone) to 75.3 (11 stone 12 pounds). The average man’s weight has gone from 73.5 kilos to 89 Kilos, a gain of more than 2 stone. The annual cost to the American economy for this extra healthcare for overweight people has been put at around $150 billion.

Inevitably, a lot of the problems causing this weight gain and health issues is as a result of too much sugar in diet. Unfortunately, it does not take much to go over the limit. A single standard size can of fizzy drink contains about 50% more sugar than the daily recommended maximum for an adult. 20% of all young people in America consume 500 calories or more a day from soft drinks, which is all the more difficult to believe when sugar is not actually very high in calories. In addition, when you consider that a lot of processed foods also contain added sugar. By one estimate about half the sugar we consume is lurking in foods that we are not even aware of, in breads, salad dressings, spaghetti sauces, ketchup and other processed foods.

Unfortunately, our liver does not know whether the sugar we consume comes from an apple or a fizzy drink. A 500ml bottle of a well-known brand of fizzy drink has about 13 teaspoons of added sugar and no nutritional value at all. 3 apples would give just as much sugar, but compensate by giving you vitamins, minerals and fibre, not to mention a greater feeling of satiation. That said, even apples are a lot sweeter than they really need to be. Modern fruits have been selectively bred to be vastly more sugary than they once were. The fruits that Shakespeare ate were for most parts no sweeter than a modern carrot. Unfortunately, also fruits and vegetables are nutritionally less good for us than they were even in the fairly recent past. A Biochemist at the University of Texas compared the nutritional value of various foods in 1950 with those of our era and found a substantial drop in almost every type. Modern fruits for instance were almost 50% poorer in iron than they were in the 1950’s, about 12% down in calcium and 15% down in Vitamin A. Modern agricultural practices, it turns out focus on high yields and rapid growth at the expense of quality.

However, despite all of these downsides, we are living considerably longer than we did in the past. By one reckoning, life expectancy has improved by as much in the 20th century as in the whole of the proceeding 8000 years. The average lifespan for an American male went from 46 years in 1900 to 74 by 2000. For an American woman the improvements were even better, from 48 to 80. Elsewhere, advances have been a little short of breath taking. A woman born in Singapore today can expect to live to 87.6 years, more than double what her great grandmother would have counted on. These rates are currently forecasted to increase, with many scientists predicting that more people will soon be living beyond 100 and maybe it will become common for people to live beyond 120.

There has also been a considerable change in the causes of death over the previous 100 years. What is most striking and the difference between the two eras is that nearly half the deaths in 1900 were from infectious diseases compared with just 2% now. Sadly, in 2011 we witnessed an interesting milestone in human history. For the first time more people died globally from noncommunicable diseases like heart failure, stroke and diabetes than from all infection diseases combined. We therefore live in an age in which we are killed more often than not by our lifestyle. We are in effect choosing how we shall die, albeit without much reflection or insight.

It is true that we have seen a remarkable increase in treatments over the past 100 years. The rise of penicillin and other antibiotics have obviously had significant impact on infectious diseases. Other medicines have flooded the market too as the century proceeded. By 1950 half the medicines available for prescription have been invented or discovered in just the previous 10 years.

We know all too acutely that Covid has had a profound impact on economies, moral and mental health. But thankfully I speak to clients and neighbours every day and more and more people are having their vaccines. This is a positive and hopefully a sign that we are finally moving out of these horrible lockdowns and on to the other side. Inevitably the path forward will be led by the vaccine and the ability for more people to be treated and build up immunity. With regard to the vaccine, last week we were listening to a presentation by the team who manage the Scottish Mortgage Investment Trust. They pointed out that although we have waited , what seems like a huge amount of time for the vaccine to appear, apparently it only took 4 days to find a solution to Covid; 2 days to sequence the virus and 2 days for Moderna to develop the molecule to respond to it. The rest of the time between then and when the vaccine rolled out was due to regulatory issues.

This remarkable innovation in healthcare and the inevitable changes in lifestyle, life span and population growth are the reason why we keep coming back to our themes and why we believe that these trends will keep on increasing. As we have just pointed out there are huge increases in demand for healthcare and improvements in lifestyle, even without the natural increase in the global population and the moves from rural areas to concentration in urban areas. We know that by 2050 70% of the world’s population will be over 65 and the world’s population will continue to grow, driven by improving life expectancy and lower fertility rates, how we work, pay tax and save will change and the patterns of consumption will shift, bringing opportunities within the financial and, more importantly, the healthcare sectors.

It is also unusual to notice that despite the huge amounts of money spent on healthcare and lifestyles, unfortunately life expectancy in America is considerably lower than other nations, and therefore implies that being the wealthiest nation does not necessarily provide you with health benefits. A randomly selected American aged 45 to 54 is more than twice as likely to die from any cause as someone from the same age group in Sweden. If you consider that for a moment; if you are a middle aged American, your risk of dying before ‘your time’ is more than double that of a person picked at random off the streets in Sweden. For every 400 middle aged Americans who die each year just 220 die in Australia, 230 in Britain, 290 in Germany and 300 in France. This would appear to be counter intuitive, when you consider that Americans spend more on healthcare than any other nation, 2.5 times more per person than the average for all other developed nations in the world. 20% of all the money Americans earn (on average this equates to $10,209 a year per citizen) equating to $3.2 Trillion is spent on healthcare. It is the nation’s sixth largest industry and provides 12.5% of its employment.

You cannot get healthcare any higher on a national agenda without putting everyone in a white coat, yet despite that generous spending and the undoubted quality of American hospitals and healthcare, the US comes just 31st in the global rankings of life expectancy behind countries such as Cyprus, Costa Rica and just ahead of Cuba and Albania.

It is therefore interesting to read how academics explain such a paradox. The most inescapable fact is that Americans lead an unhealthier lifestyle than most other people. The average Dutch or Swedish citizens consumes 20% fewer calories than the average American. That does not sound massively excessive, but it adds up to 200,000 calories over the course of a year. Life in America is also much riskier. Unfortunately, Americans drink and drive more than almost everybody else and wear seatbelts less devotedly than everyone else in the rich world, apart from Italians. Nearly all advanced nations require helmets for motorcycles and passengers, and yet in America 60% of states don’t and 3 states have no helmet requirement at any age. I’m not even going to get started on guns.

As we pointed out earlier because of improvements in healthcare we are living longer, and sadly older people cost the economy a lot. In the United States the ‘elderly’ constitutes just over a 10th of the population but fill half of the hospital beds and consume 33% of all medicines. For example, it has been estimated that fixing and treating falls among the elderly costs $31 Billion a year.

We are now also spending more time in retirement. The average person born before 1945 could expect a retirement of around 8 years. But somebody born in 1971 can expect more like 20 years of retirement and someone born in 1998 can on current trends can expect 35 years in retirement. All of these retirement plans are in general funded by roughly the same 40 years of working lifetime and as a consequence most nations have not begun to face up to the long term costs of having so many people not working and the cost of treating them into retirement.

Moving back to predicting the future, we can always look forward and make an assumption that if sales grow by a certain amount then we can build an argument that a share price is attractive. We can also do sums that show us we need to move away from expensive parts of the markets which have risen for no other reason that momentum has taken hold and build up our exposure to the areas where we are seeing demographic improvements and statistically proven themes.

This is imperative as we continue to look to grow our capital and assets in what could be a low growth world. There will be an awful lot of media noise about certain sectors that have grown very quickly and those which will benefit after we emerge from lockdown. We also know that people will want to spend money when we come out of the crisis. We have all spoken to numerous people who cannot wait to go on holiday or go shopping or travel to meet family. This will be an inevitable consequence when freedoms have been restricted, but we don’t wish to get drawn into those sectors that are fundamentally flawed. Inevitably, there will be a rebound in the fortunes of holiday companies and the airlines, but that does not mean to say that they are sustainable long term investments. Consumer cash will be spent on eating out, travelling and just being sociable, but this again does not justify chasing those old economy sectors that are fundamentally broken. We want to focus on the desire of wanting to live longer, look after ourselves and be healthier.

Hence the reason why we believe that thematic investing is so important. It enables us to ignore regional barriers and we just focus on the secular growth trends and inevitably these themes are growing at a faster rate than most geographic economies and we are not bound by an index that says we have to hold x% in banks, etc. As we have pointed out on numerous occasions themes are decade long growth phenomena. It forces us to think differently about the world, looking at the lifecycle of the millennial generation allows us to look at the way they will lead their lives in the future, especially when they become more influential in managing companies and politics. This generation will focus on the environment, helping others and wanting their money to do better for the future.

To put things into perspective. Healthcare represents 12.95% of the MSCI World index, which is 3 times as big as the whole of the UK market.

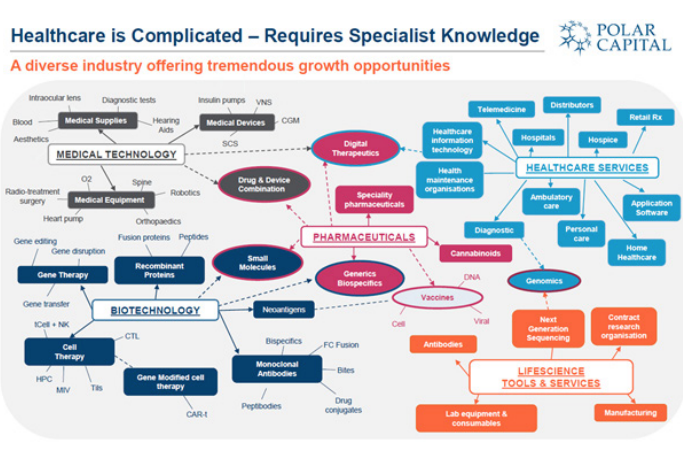

I am also including a fascination slide I have taken from a Polar Capital presentation.

It clearly highlights why investing in sectors has changed so much and why it is no longer so simple as buying a pharmaceutical company and hoping that gives you full exposure to the sector. It has grown in complexity and to stand a chance of covering all of the fields we need to use funds and in the case of healthcare and lifestyle more than one fund.

Conclusion

I hope that you have picked up on some of the comments highlighted in bold. These show some of the huge amounts of money spent on healthcare at the moment. These are massive sums of money and as populations continue to grow and get older these figures are only going to go one way. Hence why we are confident that we can see into certain parts of the future with some degree of certainty and we have invested so heavily in the healthcare and lifestyle themed funds in the portfolio.

So, overall, whilst certain sectors and companies may be looking overvalued and expensive, we have to bear in mind that there are reasons for this but we also have to look beyond the short term noise and reflect on the quality of assets we are buying and they will change the way that we need to invest. Inevitably, investors are paying more for this growth potential and this has pushed prices up. But we feel that these markets and economy sectors will continue to grow. This in turn will result in a pickup in corporate earnings which in turn will drive earnings and, more importantly, dividends. This is the long term growth that will help capital go grow. It therefore does require us to continue to invest money in these sectors and we feel that the demand for these goods will continue, especially as we move out of lockdowns. The size of these themes also means that we can now actively asset allocate, and we would only buy if an asset is attractively priced.

We do not have to hold on to sectors if they are expensive as there are other assets within these themes that allow us to diversify. On top of healthcare, hardware and technology is a phenomenally big sector. It is anticipated that at the moment the market in the technology sector equates to $28 Trillion, which is about the same size as all of the stocks quoted on the New York Stock Exchange. We will cover this in the next commentary as that is also a massive topic.

Pub quiz fact of the day

The terms sterling and pound can be traced back to the fact that paper notes could originally be swapped for pounds of silver held in reserve by the Bank of England. The UK then entered the “Gold Standard” in 1844 and left it in 1931. During most of the period, pound notes could be converted into gold at a fixed rate of £1 for 0.235 troy ounces of Gold. But by that time the phrase pound and sterling were too well entrenched into day to day living to change again. Otherwise we might have been spending 'troys'.

As per usual, I hope that is all helpful. If you have any questions, then please do not hesitate to contact us here in the Office.