Companies will do well by doing good things

18/10/20

Simon Martin, Branch Manager and Senior Investment Manager, Charles Stanley Leeds

Companies will do well by doing good things

Dealing with Covid has created huge implications for many people, companies and all governments around the world. But the biggest implication is the simple fact that for probably the first time ever, we are living in a global economy where governments have deliberately put their respective economies into a recession. I am sure that it will be OK in the end but for the time being we simply don’t how this will all evolve, but we know that we have to think differently.

We have to keep ignoring recency bias (i.e. the issues that have dominated news over the past few months) and look beyond what has made money in the past, hence we are no longer talking about value v growth, or obsessing about how expensive the large US tech holdings are and how this has implications for driving momentum. Those things will continue to drive markets, but we have to get the bigger framework right and portfolios pointing in the right direction.

We also have to be mindful of what might change after Covid. There will undoubtedly be an increased focus on health and climate change. For a number of years, around the world, air pollution has been consistently killing 8 times more people every year than Covid has done in the 6 months up to the end of September 2020. Particulate matter in our respiratory system makes us far more vulnerable to any type of respiratory infection and therefore needs to be addressed to avoid us having to go through the same restrictions that we have been enduring since March. This is an issue that is not going to go away and will simply become more and more important over the next few decades.

You may remember that in our last Market Commentary we introduced the new theme about decarbonisation and why we feel it is a viable investment opportunity in its own right. Over the past few weeks, we have undertaken a lot of research on this issue and the general consensus amongst the various product specialists and experts we have talked to is that we are at an inflection point within this sector of the market.

As we pointed out in the last commentary it is expected that least $50trilion to be invested globally over the next 20 to 30 years (one report talked about figures over $200trillion) on reducing carbon emissions, which provides a phenomenal investment opportunity for us. This is not just about the general population making small changes to the way they live, this is about Government initiatives, such as European Green Deal and plans that Mr Biden may adopt if he is successful on the 3rd November. ]

We are choosing to invest in this sector because not only does it help to save lives and the environment but as the title of this commentary suggests those companies that choose to do the right thing will generate the most returns over the next 20-30 years and we want to benefit from these returns to help grow your investments. We are aware that environmental issues have generated an awful lot of headlines over the past few years and we do not believe it is a fad that just makes investors feel better in themselves. Looking at the growth potential and sums of money involved we believe that this is the start of a major expansion that will generate huge investment returns for many years to come.

This decarbonisation and green energy revolution is not solely focused on electric vehicles and clean energy. It involves making this sector far more competitive and efficient. We know that over the past 8 years, solar energy costs have fallen by over 80%, that onshore Wind energy costs have fallen by 45% and that the price of energy storage and lithium ion battery has fallen by 88%. This is all vitally important to allow companies to continue to move towards adopting green energy, but these costs have to continue to fall, and these companies have to become even more efficient in order to be able to compete with the current energy providers and completely disrupt these markets.

Being net-zero CO2 emissions by 2050 will be very challenging, especially given the growth projections for energy demand. This is because, over the next 30 years also we expect global energy consumption to rise by 74% alone and most of this will be driven by demand from China, India and other emerging markets. As a consequence of all these trends, by 2035 nearly half of global total electricity capacity will be in solar and wind with China and India the main contributors. Therefore, although they are portrayed as currently being the main polluters, they could in fact be the economies that help lead us out of the pollution problem and reduce the historical demand for oil and gas. This is because countries like China and India hate being reliant on other countries for important energy commodities. They want to be self-sufficient and be in control of their own power generation. We know that oil only exists in certain parts of the world, but wind and sun exist everywhere, which is why we believe the growth projections.

Irrespective of this desire for countries to control their own power supplies, in order for companies to be able to compete they need prices to fall further. For example, we have industries that require enough power to heat raw materials, such as glass, brick and cement up to temperatures in excess of 1,400 degrees and this needs to be done efficiently and cheaply. This also has to be achievable in all weather conditions, seasons and at night. These are the challenges that the renewable energy face.

As we mentioned earlier it is not just about renewable power, it is also about making buildings more energy efficient, altering diet, making meat production more efficient and less polluting and also requires a lot of work on recycling. It also involves us reducing the amount of energy required to do certain processes and making things more energy efficient. The adoption of more technology into the process will also be important, for example an electric vehicle requires twice as many semiconductors as a current car. On average a standard car has 355 semiconductors and a standard Electric vehicle uses 695. Therefore, if we extrapolate this argument to support the business case it is anticipated that over the next 20 years the global car industry will have built over 40 million electric cars and needs around 27.8 billion semiconductors just to allow us to drive around and that’s before we get into the realms of self drive technology.

Buildings account for 29% of global energy consumption and they represent a significant potential for energy savings. The real estate’s focus on energy efficiency in green buildings has accelerated in recent years and a trend that is expected to continue with focus on improving the heating, insulation, cooling, lighting, cooking and appliances.

We will also be looking into scenarios such as energy storage. Unfortunately, a number of renewable power supplies are not always efficient 24 hours a day, 7 days a week and 52 weeks of the year. Also, some energy processes are much more efficient in other parts of the world. For example, solar power generation is obviously much more efficient in Spain than in northern England or Scotland, and therefore we need to be able to evolve a way of either storing this electricity or transporting it much more efficiently. At the moment we are starting to develop the capacity to store electricity for short periods, but the challenge will become arranging a storage facility that holds on to energy that is created in the summer for 6 months to allow us to use it in the winter. This is very challenging and area that will need to be evolved and adapted more widely over the next few years.

With developing countries populations and wealth increasing alongside urban expansion industrial waste management is becoming a priority. This growth will drive demand for food and in particular proteins which consume more resources than grains. There is therefore an economic imperative to increase efficiency throughout the food chain. We know that at the moment in the developed world a third of edible food is wasted. Consequently, resilient agricultural practises which can adapt to climate change are also key to meeting this demand. It therefore makes sense that businesses which mitigate environmental damage by facilitating and reusing will generate large net gains in the global economy.

Not only do we need to reduce the emissions that animals make, but it is also the emissions caused by transporting the produce around the world. There are companies developing supplements that reduce the methane that cows emit.

We also know that climate change and environmental damage and the shifting of consumption patterns is also putting increased stress on clean water resources creating shortages in some areas, and unfortunately floods in others. As a global economy, we face huge demographic challenges, with global populations increasing whilst water supply is not. At this moment in time the total world’s water resources are 200,000 cubic Kilometres, with a population of 6.6billion. By 2050 we will still have the same amount of water resources, but the population will have risen to 9.3billion, which means that we have to be more efficient in utilising this precious resource.

This why we have concluded that we are at in inflection point and why it is an extremely viable investment opportunity.

The global climate sector is no longer a niche market and the climate and environmental universe can be compared to a number of global equity markets. We therefore feel that this market has matured sufficiently with sufficient companies to be able to provide a diversified portfolio without running the risk of momentum driving the prices up and there being no alternative companies within the sector to be able to bank profits and move to other area in the decarbonisation theme. At the moment there are approximately 1,200 companies that fit into this segment and the market capitalisation of that sector is almost 3 times bigger than the UK market and roughly the same size as the Japanese market. Therefore, in theory we should have at least 7.5% of our equity money invested in this sector!

As a consequence of all this research we have investigated a number of funds that will enable us to benefit from this theme and we have interviewed a number of fund managers with a view to adding the funds to the portfolio. The three that we have chosen are the Pictet Clean Energy Fund, Goldman Sachs Environmental Impact Fund and the Nordea Global Climate Fund. We feel that the combination of these funds will provide a solid foundation around which we can start to build the decarbonisation theme within the portfolio.

When this is combined with other themes such as sustainable water, smart materials and other funds that we are planning to add to the portfolio it will, we believe, generate substantial growth over the next few years.

We also believe that over the next 20 years clean energy will stop becoming a theme and will evolve into becoming mainstream and the new normal. The energy sector within the MSCI Index will then be made up of the renewables companies and these will start taking over from the current fossil fuel energy stocks.

Covid has inevitably changed the way we need to allocate funds and we therefore have to continue to look beyond simply buying geographies that have done well in the past. Funds that only invest in geographies inevitably have exposure to sectors that are becoming inherently old fashioned and this is not a viable way of managing money going forward. Just because banks, insurance companies and oil companies have done well in the past does not necessarily mean that they will do as well in the future. We will continue to require their services, but the margins will continue to be eroded and therefore make it increasingly difficult to generate realistic returns that drive long term capital growth, so therefore we need to invest for the future and not the past.

This was confirmed in a report written by Goldman Sachs, who recently forecasted that true long term growth will become increasingly scarce in public markets. They estimate that over the next few years only 15% of companies will generate earnings growth over 8% per annum, (this is been down from 25% this time last year). Therefore, we have to focus our capital much more intelligently to benefit from these trends, especially as the percentage of companies growing at less than 4% will double to represent over 50% of the portfolio within the next few years. These companies are still growing but we want to focus on those doing twice as well. We have to therefore look harder to be able to identify where the real growth trends are and for this reason, we need to adopt a more thematic led process.

Conclusion

We know that pollution and climate change are already threatening human health and having an impact on economic activity. Population growth and rising wealth will continue to increase this demand for increasingly scarce resources. Social pressure and demographic change and international agreements are driving policy’s support for improved environmental stewardship and efficient production of consumption, and those businesses which can adapt and support the energy revolution, reduce water intensity and limit waste are at the forefront of a multi decade long growth opportunity.

We are not going to stop needing products from the oil industry, but the prices may not be there for many companies or in fact countries to be able to produce oil effectively. Therefore, old “value” will continue to underperform. Banks will continue to pay big fines and in a low margin environment will not generate any growth. Utility companies need to reform and focus themselves on renewable energy and cannot rely on old fashioned gas and oil powered stations, and many of these old world companies have phenomenal amounts of leverage which will restrict what they can do and when they can do it, whereas many of the modern companies in the clean energy environment don’t have this baggage of leverage or old world property and as a result they are able to evolve into the new world. This is why we feel that focusing on themes is such an exciting investment opportunity and one that we will continue to adopt and expand on over the next few years.

This week’s facts!

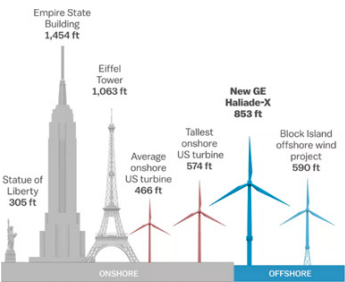

Average turbine size has been steadily increasing over the past 30 years. Today, new onshore turbines are typically in the range of 2 – 5 MW. The largest production models designed for offshore use can generate 12 MW; some innovative turbine models under development are expected to generate more than 14 MW in offshore projects in the coming years.

The output of a wind turbine depends on the turbine’s size and the wind’s speed through the rotor. In Europe the average existing onshore wind turbine with a capacity of 2.5–3 MW can produce more than 6 million kWh in a year – enough to supply 1,500 average EU households with electricity. Therefore, as you can calculate the next generation of offshore turbines will be able to each power over 8000 houses each!

As per usual I hope you found this of interest. I also hope to

expand the discussion on themes over the next few weeks. If you

have any comment or questions, please do not hesitate to call us.

We genuinely do welcome feedback and comments as they are

really important as we develop these themes.